Public Debt and Economic Stability in Tanzania

Kochecha Heriel

(@kosahm)

The Tanzanian economy is continuing to prosper with an annual Gross Domestic Product (GDP) averaging 7% as per World Bank and IMF reports. The performance and increasing trends of GDP is attributed, to a great extent, to the buoyant performance of construction, trade, agriculture, services and transport sectors. Its projection is promising in contrast to the real picture behind the scene. The distribution of the national cake is still unequal in urban and rural populations. The World Bank overview report shows that, about 12 million Tanzanians are still living in poverty.

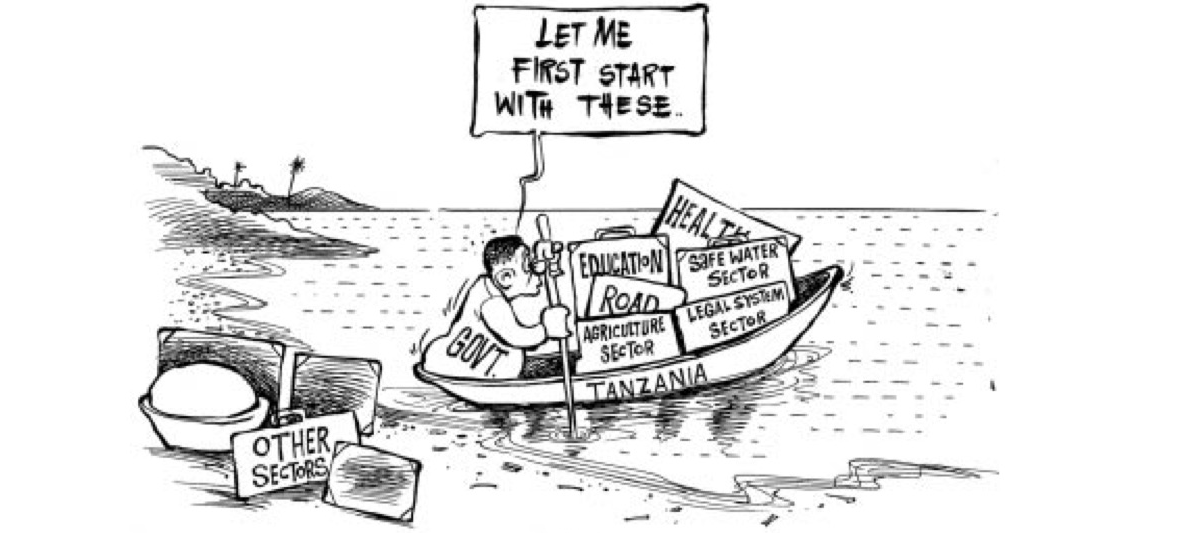

In fact, the same development challenges that faced Tanzania since 1961 are still debates and topics of the day. Mwalimu J.K Nyerere (the founding father of the nation) declared war against poverty, diseases, and ignorance. Worse enough, fifty years down the line, with five presidential terms, the country and its administrative system is still swimming in the same ocean with increased tragedies and development challenges such as fraud, rampant corruption, infrastructural bottlenecks, unemployment, illiteracy, diseases, poverty and power inaccessibility. There has been numerous development programs, slogans and jargons with little or any profound achievements, especially when one looks at value for money.

The national debt burden and the gap between the “haves” and the “have-nots” are widening. In April 2000, the IMF and the World Bank classified Tanzania as a heavily indebted country and thus eligible for enhanced Highly Indebted Poor Countries (HIPC) debt relief assistance. There has never been concrete efforts to reduce the increasing debt burden despite the IMF and the World Bank’s regular alerts and reports. What has been persistent, and regularly practiced by the government in relation to this, is increasing the share of government expenditure to GDP ratio in a bid to reduce the savings-investment gap and minimize the Balance of Payments (BOP) problems.

According to the World Economic Forum (WEF), in its global competitiveness report (2015-2016), in which Tanzania was ranked 120th out of 140 countries, there were a number problems which require immediate attention: quality of overall infrastructure (115th out of 140 countries); irregular payments and bribes (121st out of 140 countries); quality of electricity supply (120th out of 140 countries). All these hurdles, including others attributes, have had far reaching negative effects, both direct and indirect, in the economy. These include deterring investments, both local and foreign, reduced local production, which in turn results into increased importation and Balance of Payment (BOP) problems.

The overall situation has slightly improved over the year with the WEF’s global competitive report for 2016-2017 ranking Tanzania as 116th out of 138 countries. In terms of the macroeconomic environment, the two successive WEF reports indicate that the country has moved from being number 111 out of 140 countries to 106 out of the 138 countries in terms of the annual percentage change in inflation. However, its ranks for country’s crediting rating has shifted from 103 out of 140 countries to 109 out of 139 countries. Its government budget balance as a % of GDP moved from a value of minus 3.9 to minus 3.3, corresponding to a shift in ranking from being number 90 out of 140 countries to number 83 out of 138 countries. The WEF reports show its ranks for Tanzania’s general government debt as a % GDP shifted from number 43 out of 140 to number 54 out 138.

In a similar vein, the IMF report for 2016 indicate that Tanzania’s total public sector debt (internal and external) gradually increased from 20% of GDP in 2007/2008 to an estimated 37.5% of GDP in 2015/2016. Worse enough most of borrowings were from commercial sources due to decrease in aid and concessional loans from development partners and other multilateral agencies.

In the modern world, no country has yet moved from being underdeveloped to being developed or industrialized without borrowing. Therefore, the problem is not borrowing or the size of borrowing but how do we use the credit towards economic growth and development without falling into the trap of defaulting or overpaying. Specifically, to our country (Tanzania), statistics shows that, while the total government expenditure demonstrated an increase of 6.2% from 17.7% in the financial year 2008/9 to 23.9% in 2015/16, the domestic revenue collection grew only by 1.9% from 12.2% to 14.1% in the 2008/9 and 2015/16 respectively. This calls for external borrowing in order to fill the expenditure gap.

From an analytical point of view, if all is said and well understood, we must not concentrate on faults and criticism only but also on the remedies that are vital for progress. The question is; should Tanzania stop borrowing or what should be done with respect to the present economic situations facing the country. The relatively new political regime under President John Magufuli shows a promising future especially in terms of accountability, governance and investment in development projects; however, it is too early to judge with respect to the challenges lying ahead.

President Magufuli’s fifth phase government ought to ensure, especially in regard to debt sustainability, that the country channels most of its borrowings to investments projects rather than recurrent expenditures as it used to be in earlier presidential reigns. Efforts must be put in place to ensure that all the investment projects realize value for money as per the specified objectives and timeframe. For instance, a big stake of the budget for the government’s five-year development plan (FYDP-II), with its potential investments on hydropower plants, roads, a standard gauge railway, the Dar es Salaam Port, the water and transportation systems should be sourced through Public Private Partnership (PPP) and, where necessary, through concessional loans. This will reduce the government’s borrowing and risk to debt sustainability.

In line with this, the government should use its diplomatic ties and international relations to lobby for concessional loans to fund its development projects from agencies such as the African Development Bank (ADB), the Export-Import (Exim) Bank of China, India, Japan Bank for International Cooperation (JBIC) and the likes due to their generosity, low interest rates and long grace period compared to market loans from conventional International Financial Institutions (IFIs).

Tanzania still lacks adequate technological expertise and personnel in almost all domains. This has been attributed to the use of borrowed money (forex) for purchase of equipment and paying for the technical services rendered by international experts, hence the exposure to exchange rate fluctuations and persistent depreciation of the Tanzanian shilling against foreign currencies especially the Unites States of America’s Dollar (USD). Therefore, the government should focus on borrowing from countries which do not use USD such as Japan, China, Germany and the UK hence reducing exchange rate volatility taking into account that, until June, 2015, the total external debt was dominated by USD at 54% while Euro was only at 18%.

On the other hand, there should be a separate agency with full autonomy entitled, by law, to audit all the government borrowings, payment plans and produce reports (both Swahili and English) in a very transparent manner. To make things more transparent, the reports should be discussed and debated in the parliament. This will ensure optimal and effective use of government borrowings hence eradicating the occurrence of embezzlement of funds and related financial misconducts like stealing of $133 million (Sh279 billion) from the External Payment Arrears Account (EPA) from the Bank of Tanzania (BOT) in 2005/06.

Contracts transparency is an issue of concern and should be addressed immediately. All contracts relating to extractive industry such as oil, gas and mining should be disclosed and well known to the public. Those who have experience with Participatory Rural Appraisal (PRA) techniques would concur with me that, whether educated or not, citizens are researchers. They are good in investigating and seeking informatio. As such, through contract disclosure, they will be allowed to monitor contracts in areas such as environmental compliance where they may be better placed than the government. This would reduce or eliminate the resource curse problem facing other countries like Nigeria, Sudan and Somalia.

The backbone of Tanzania’s economy with more than the estimated 50 million people is based on agriculture. This suggests that the government has to undetake several reforms to free the agricultural sector from all technical and business related shackles. Among the key areas for agricultural reforms include increase in agricultural subsidy, price stabilization, adoption and sustaining of agricultural based irrigation, promoting agricultural extension, agricultural mechanization and more efficient intermediation of savings into capital formation for agriculture and its related activities.

Investment in the industrial sector is vital and inevitable. Tanzania is experiencing inflation, loss of currency value against other currencies especially USD and BOP problems caused by importation of a litany of goods which can even be produced locally. It is only through revamping the old and dead industries and increasing investment into other new industries that we can do so. Such investment in the industrial sector will have far reaching direct and indirect impacts to the economy and the community at large through employment creation and increased revenues. The BOP problem will also be addressed through increased exportation and reduced importation. The production, supply and distribution of reliable electricity requires our sustained attention. Electrical power is the engine and heart for increased production in all sectors of the economy, particularly in industries, mining and agriculture.

Despite the fact that, IMF Debt Sustainability’s Analysis (2016) and the Ministry of Finance’s Medium Term Debt Management Strategy (2015), underscore that Tanzania’s risk of debt distress remains low and none of them have breached the respective threshold as per their indicators, for a developing country like ours, with rampant corruption, an underperforming export sector, Balance of Payment (BOP) problems and inflated currency, borrowing needs to be well scrutinized and allocated. Therefore, the government should remain firm on implementing prudent fiscal policy, opt for appropriate financing mix coupled with strengthened debt management capacity and continuous financial and public reforms.

Its a contractive idea to launch this blog. Its my great hope that, it will take a lead and invite more people if and only if you focus economics without dig deep into politics. though, economics are influenced much with politics. But both african politicians and citizens are more biased by their personal interest than national interest..they are not ready to be criticised.